Signs Your Child May Be Affected by Financial Stress

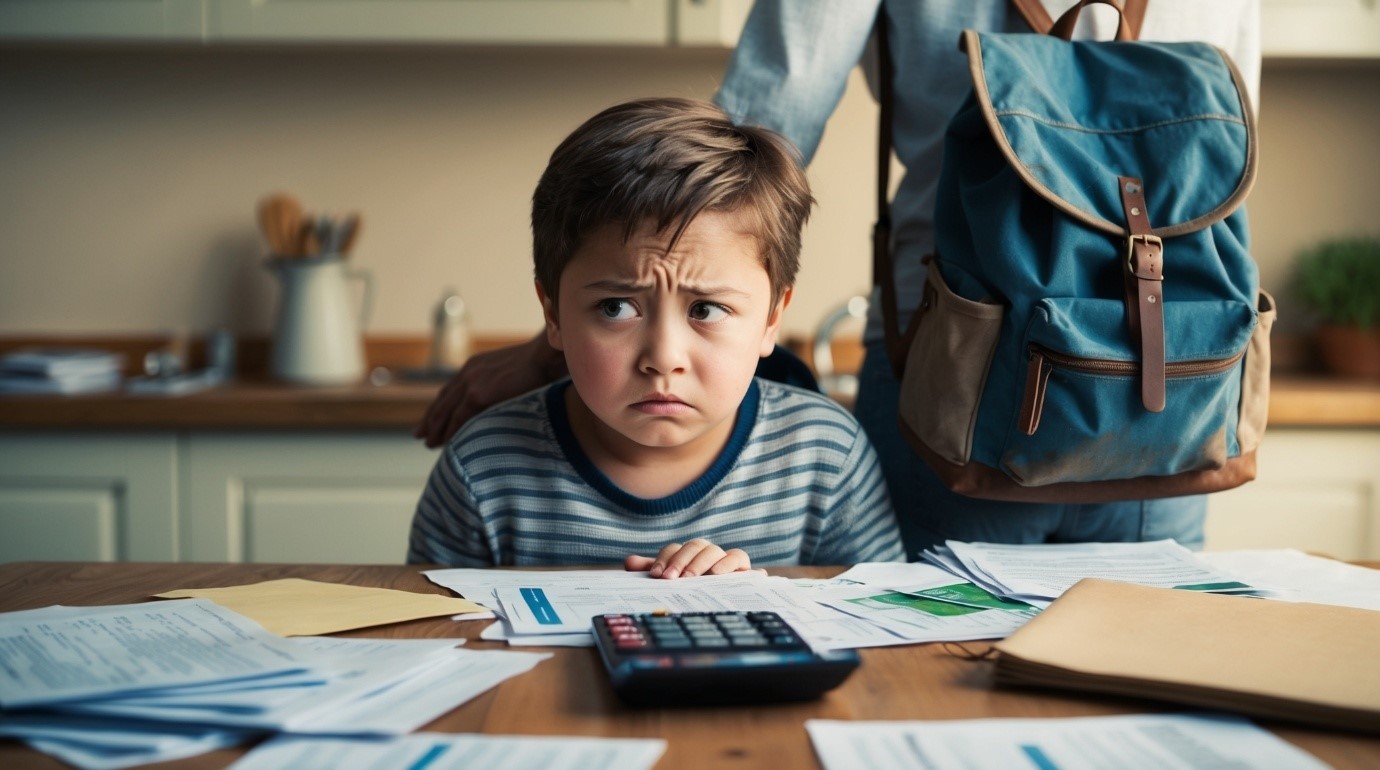

Managing finances as a single parent can be a daunting task, and it’s easy to feel overwhelmed by the pressure. Financial stress may affect your child, as they may pick up on the tension in the household. Children are remarkably intuitive, and they may internalise your worries even if you’re doing your best to shield them. By understanding how financial stress affects both you and your child, you can take steps to provide support and reassurance during these tough times.

Understanding How Financial Stress Impacts Your Child

When financial stress weighs heavily on you, it can spill over into other areas of life—especially your child’s emotional wellbeing. Stressful financial situations can create an unstable environment that makes children feel insecure, anxious, or confused. As a single parent, it’s crucial to recognise how your child may be reacting to financial difficulties, even if they don’t explicitly express it.

Recognising the Signs of Financial Stress in Children

Here are some key signs that your child may be impacted by financial stress in the home:

1. Increased Anxiety or Worry Children, even at a young age, are often keen observers of their surroundings. If your child seems more anxious or worried than usual, it could be a sign that they’re picking up on your financial stress. They may not fully understand the cause, but they feel the change in the atmosphere.

Children can sense financial stress, but you can provide comfort with open, age-appropriate communication.

2. Changes in Behaviour Stress often manifests in behavioural changes. If your child is suddenly more withdrawn, irritable, or having trouble concentrating at school, these could be signs of emotional distress linked to financial worries. Keep an eye out for these behavioural shifts as they may indicate that the child is struggling emotionally.

3. Regressive Behaviours Older children or teens may regress in their behaviour, becoming more clingy or dependent, especially when they sense their security is threatened. This can be their way of seeking comfort in uncertain times. If your child is asking for more reassurance or exhibiting behaviours they previously outgrew, this may be a sign of stress.

4. Physical Symptoms of Stress In some cases, financial strain may manifest physically, such as stomachaches, headaches, or trouble sleeping. Children may not always connect these symptoms to stress, but as a parent, it’s important to understand that physical complaints can often stem from emotional turmoil.

Stress can manifest physically, so pay attention to any unexplained aches or pains.

Learn more reward ideas in Top 10 Reward Systems for School-Age Kids in Single-Parent Homes.

How to Talk to Your Kids About Financial Stress Without Worrying Them

As a single parent, talking to your children about financial stress can be challenging. Financial stress may affect your child, so it’s important to have open, honest conversations in an age-appropriate way to prevent them from becoming unnecessarily anxious. By explaining the situation calmly and offering reassurance, you can help your child feel safe and secure, even in difficult times.

explore our related article on managing parental stress: “How to Manage Parental Stress While Supporting Your Child’s Education.”

1. Be Honest, But Age-Appropriate

Transparency is key, but sharing too much information can cause unnecessary stress. Here’s how you can approach this conversation based on their age:

It’s important to reassure them that you are managing things, so they don’t feel burdened by adult worries.

2. Reassure Them That It’s Not Their Fault

Children often internalise stress, thinking that they caused it. Reassure them that the financial challenges are not their fault and that it’s something you, as their parent, are responsible for.

Some comforting words could be:

This reassurance can alleviate feelings of guilt or confusion they may have.

3. Involve Them in Age-Appropriate Money Decisions

Involving your child in age-appropriate money decisions can help them feel empowered and learn financial responsibility. It also shows them that you’re handling the situation with care, which can provide comfort.

This involvement teaches valuable lessons about financial management while fostering a sense of control and responsibility.

Learn more about the benefits of routine in our article: “The Importance of Consistent Routines for Single Parents and Kids.”

How to Help Your Child Cope with Financial Stress

It’s not just about talking to your child—there are practical steps you can take to support them emotionally during stressful financial times.

Create a Safe and Predictable Routine

Maintaining consistent routines can help provide stability for your child. Financial stress may affect your child, and when everything around them feels uncertain, routines act as a comforting anchor. A predictable bedtime, regular mealtimes, and designated times for homework and play can help reduce anxiety and provide your child with a sense of normalcy.

For more support strategies, explore our article: “How to Co-Parent Successfully When You’re a Single Parent.”

Encourage Open Communication

Foster an environment where your child feels comfortable sharing their thoughts and feelings. Ask open-ended questions like, “How was school today?” or “Is there anything on your mind that you want to talk about?” Being available to listen can help your child express their concerns and feel understood.

Provide Emotional Reassurance

Offer extra emotional support by spending quality time together. Whether it’s reading a book, doing a craft, or simply talking, those moments of connection can help alleviate your child’s stress and remind them that they are loved and supported.

Building Financial Resilience Together

Teaching your child about financial resilience doesn’t mean burdening them with your struggles; it’s about helping them understand the value of money, saving, and the importance of budgeting. By taking steps to talk openly about finances in an age-appropriate way, you help your child develop healthy attitudes towards money and provide them with the tools to manage their own financial situations in the future.

Additionally, it’s vital to model positive financial behaviour. Children tend to imitate what they see, so if you maintain a calm and focused approach to handling financial challenges, they’re likely to do the same.

Conclusion: Building Emotional and Financial Resilience as a Family

As a single parent, it’s essential to address both your own stress and your child’s emotional wellbeing. Financial stress may affect your child, but by keeping the lines of communication open and offering support, you can navigate these challenges together. Remember, financial stress doesn’t define your ability to be a good parent. You’re doing the best you can, and that’s what matters most.

For further tips on managing stress and supporting your child’s education, take a look at our article, “How to Manage Parental Stress While Supporting Your Child’s Education”.

How do you approach talking to your kids about money? Share your experiences, and feel free to explore our related article on managing parental stress: “How to Manage Parental Stress While Supporting Your Child’s Education.

Open, positive financial conversations help build a strong foundation for your child’s future.