Parenting and Financial Improvement: How to Manage Your Finances While Raising Kids

Introduction: The Intersection of Parenting and Financial Responsibility

Parenting is already the most rewarding—and demanding—job you’ll ever have. Add financial goals like saving for college, paying off debt, and securing your retirement, and it’s easy to feel stretched thin. But here’s the good news: parenting and financial improvement aren’t competing priorities—they’re interconnected.

With smart strategies, you can:

Provide for your children without sacrificing your own financial future

Turn everyday parenting moments into money-smart lessons for kids

Reduce money stress so you can focus on what really matters—your family

This isn’t about perfection. It’s about progress. Whether you’re tackling daycare costs, planning for milestones, or just trying to stick to a grocery budget, small, intentional steps add up. Let’s explore how to align your family life and financial goals—because you deserve to raise happy kids and build a secure future.”

This article is here to provide practical advice on managing finances as a parent. From setting up a budget that works for your family to making smart decisions about saving and investing, we will explore how you can manage your finances effectively while raising kids. By incorporating some of these strategies, you’ll not only improve your financial health but also reduce the financial stress that comes with parenthood. Let’s dive in!

Consider exploring articles like: Navigating the Digital Age: A Parent’s Guide to Protecting Kids’ Eyes and Managing Screen Time

Key Financial Challenges Parents Face

Below are some of the most common financial challenges that parents face:

|

Financial Challenge |

Description |

|

Childcare Costs |

Daycare, preschool, or after-school programs can be a significant expense. |

|

Education Savings |

Saving for college or other education-related costs can be overwhelming |

|

Living Expenses |

Groceries, housing, clothing, and utilities, everything seems more expensive with kids. |

|

Healthcare and Insurance |

Medical bills, health insurance premiums, and out-of-pocket costs for children can be high. |

|

Debt Management |

Student loans, credit card debt, and mortgage payments add pressure. |

|

Emergency Savings |

Having an emergency fund to cover unexpected expenses is a must. |

Why Financial Management is Crucial for Parents

If you’ve ever lain awake stressing about bills while listening to your child’s peaceful breathing, you’re not alone. That tension between providing now and planning for tomorrow is what makes Parenting and Financial Improvement so crucial. This isn’t just about spreadsheets—it’s about:

1. Reducing Financial Stress

A strong financial plan helps alleviate the constant worry about money. When you’re in control of your finances, you’re less likely to experience anxiety about unexpected expenses or future financial needs.

2. Ensuring Stability for Your Family

Effective financial management means that you can provide for your children without living paycheck to paycheck. It also gives you the security of knowing that you’re saving for emergencies, future goals, and retirement, which helps reduce uncertainty for your family.

3. Teaching Financial Responsibility to Your Kids

By managing your finances wisely, you model responsible behaviour for your children. They learn valuable money habits, such as budgeting, saving, and the importance of making informed financial decisions.

4. Improving Your Quality of Life

When finances are in order, you’ll be able to enjoy family vacations, hobbies, and the little luxuries in life without the constant worry about spending. Financial stability gives you the freedom to live without constraints, making it easier to focus on what truly matters.

Practical Tips for Managing Your Finances While Parenting

Mastering your money while raising a family isn’t about luck – it’s about strategy. Parenting and Financial Improvement means approaching your finances with the same care and intention you give to parenting. The good news? With the right systems in place, you can:

1. Create a Family Budget

The cornerstone of financial stability is having a budget. A family budget allows you to track income, expenses, and savings goals. By knowing exactly where your money is going, you can make better decisions and avoid overspending.

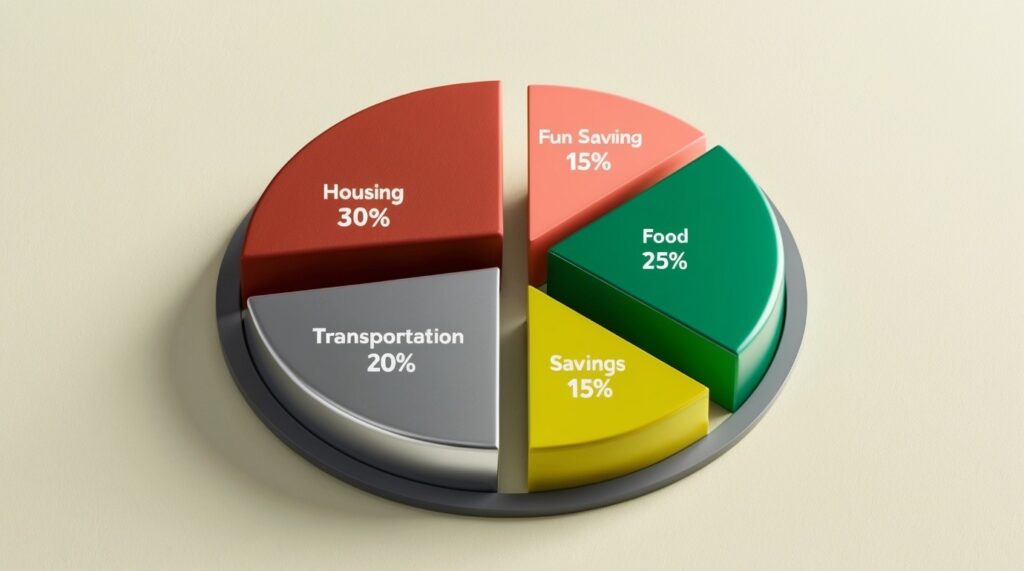

A balanced budget: Allocate your spending wisely to achieve your financial goals.

How to Create a Budget:

Consider exploring articles like: Digital Wellness for Families: A Parent’s Guide to Tech Balance in 2025

2. Start Saving Early (Even Small Amounts Count)

When it comes to saving for your child’s future, the earlier you start, the better. Even small contributions to a savings account can add up over time. Whether you’re saving for your child’s education, a rainy day fund, or long-term retirement, setting up automatic savings makes the process easier and more consistent.

Tips for Saving:

3. Manage Debt Wisely

While debt is often a part of life, it’s important to manage it effectively so that it doesn’t overwhelm your finances. High-interest debt, like credit cards, can quickly spiral out of control, so it’s crucial to make a plan for paying it down.

Debt Management Tips:

4. Take Advantage of Tax Benefits for Parents

As a parent, you have access to several tax breaks that can help reduce your financial burden. These include child tax credits, dependent care flexible spending accounts, and deductions for childcare expenses. By taking full advantage of these benefits, you can lower your taxable income and put more money back into your budget.

Tax Tips for Parents:

5. Invest in Your Future (and Your Kids’)

At the heart of parenting and financial improvement is a simple truth: The investments you make today grow alongside your children. By starting early and contributing regularly to goals like retirement or college savings, you’re not just building wealth – you’re building a foundation for your family’s dreams

Investment Tips for Parents:

Balancing Financial Priorities with Parenting

As a parent, it can feel like there’s always something that needs your attention—whether it’s the next school project, a new bill, or the kids’ extracurricular activities. The key is to strike a balance between your family’s needs, your financial goals, and your personal well-being.

Balancing priorities: Involve the whole family in financial planning to teach valuable lessons.

When you involve your children in the process and teach them basic financial principles, it becomes a learning opportunity for them. Even small discussions about saving, spending, and budgeting can lay the foundation for good money habits that will serve them well into adulthood.

Why Financial Literacy Matters for Parents

In addition to managing your own finances, it’s essential to focus on teaching your children about money. Financial literacy is a critical life skill, and parents are often the first teachers in this area. By sharing lessons about budgeting, saving, and investing, you empower your children to make informed financial decisions as they grow.

If you’re looking for resources to support your children’s learning, consider exploring educational apps or tools. For example, Top Educational Coding Games for Kids Ages 8-12 in 2025 may also include games that teach money management and problem-solving skills.

Conclusion: Taking Control of Your Finances for a Better Future

Parenting and Financial Improvement begins with recognizing that effective money management as a parent demands strategic planning, consistent discipline, and regular attention. The good news? By applying the right approaches, you can simultaneously achieve financial success while significantly reducing the unique pressures that come with raising a family. This powerful combination allows you to secure your children’s future while maintaining your own financial well-being.

Remember, financial success is a marathon, not a sprint. Stay disciplined, keep learning, and don’t be afraid to ask for help when you need it. With time, you’ll see the positive impact of your efforts on both your family’s financial health and your overall well-being.

For more tips on managing technology and finances in your family life, consider exploring articles like How to Set Up Screen Time Limits on Android Devices or Navigating the Digital Age: A Parent’s Guide to Protecting Kids’ Eyes and Managing Screen Time. Both can provide valuable insights into managing family life in the digital age while balancing your financial priorities.