The Ultimate Guide to Financial Literacy Apps for Teens: Teaching Money Smarts in a Digital World

Introduction: Why Financial Literacy Apps? A Modern Approach to Money Management for Teens

In today’s fast-paced, technology-driven world, traditional lectures on budgeting, saving, and investing often fail to capture the attention of teens. Financial literacy, however, is an essential life skill that plays a key role in future success and security. Sadly, it’s often overlooked in school curricula, leaving many teens unprepared for the financial challenges they will face as adults. That’s where the Best Financial Literacy Apps for Teens come in, offering engaging, interactive tools to help them develop these crucial skills.

smartphones.

Empowering the next generation—teaching money management skills for a brighter financial future, one app at a time!

Fortunately, financial literacy apps have emerged as a modern solution to this problem. These apps provide a fun, interactive, and engaging way for teens to learn about money management, making it easy for them to understand complex financial concepts at their own pace. By using financial apps, teens can gain a strong foundation in budgeting, saving, investing, credit management, and debt management—all from the convenience of their

Key Benefits of Financial Literacy Apps for Teens:

1. Immediate Feedback and Real-Time Tracking: Teens can see the immediate impact of their spending and saving decisions, reinforcing responsible financial habits.

2. Interactive Learning Through Gamification: By transforming finance into a game, these apps keep learning fun and engaging for teens.

3. Accessible Digital Platform: Financial apps are available anytime, making it easy for teens to incorporate financial lessons into their daily lives.

4. Development of Lifelong Skills: Financial literacy apps teach practical skills—budgeting, investing, and money management—that teens will use well into adulthood.

Parent Testimonial:

“After trying multiple methods to teach my son about saving and budgeting, we found that financial literacy apps were the most engaging. He’s now more confident managing his allowance and saving for bigger goals.” — Carla, mother of a 16-year-old

Top Financial Literacy Apps to Build Money-Smart Teens

Empowering teens with the tools they need to take control of their financial future—smart money habits start here!

Here’s a curated list of the Best Financial Literacy Apps for Teens, designed to help them understand money management. Each app focuses on a different aspect of financial education, such as budgeting, investing, earning, understanding credit, and more, giving teens the tools they need for a secure financial future..

These apps are perfect for helping teens take control of their financial futures.

|

App Name |

Focus |

What It Does |

Why Teens Love It |

How To Use |

Impact |

|

Mint |

Budgeting |

Tracks spending, sets budgets, monitors expenses |

Intuitive, fun, and personalized |

Track expenses for a week, set goals |

Helps make smarter spending decisions |

|

Stash |

Investing |

Teaches investing with fractional shares |

Simple, low-cost entry |

Family investment challenge |

Introduces investment basics and risk |

|

Debt Payoff Planner |

Debt Management |

Shows debt repayment and interest impact |

Visualizes debt costs |

Set up loans, explore repayment options |

Teaches the value of saving vs. borrowing |

|

BusyKid |

Earning & Budgeting |

Tracks chores, allowances, savings, and donations |

Links chores to earning money |

Assign chores, track earnings |

Teaches work ethic and financial responsibility |

|

Credit Karma |

Credit Management |

Shows how actions affect credit scores |

Simulated credit journeys |

Use score simulation, track progress |

Teaches the importance of maintaining good credit |

Overview

What It Does: Mint is a top-rated budgeting app that allows users to track spending, set customized budgets, set financial goals, and monitor their bank accounts and expenses in real-time. It’s perfect for teens who want to learn how to manage their money effectively.

Why Teens Love It: Mint’s intuitive interface and easy-to-use features make budgeting feel like a fun and interactive experience. Teens can categorize their expenses, visualize their spending habits, and understand how small purchases add up over time. It’s a great tool for teaching financial responsibility while keeping things engaging and simple.

How to Use Mint for Teens

To introduce your teen to budgeting, start by challenging them to track all of their expenses for a week using Mint. You can even make it a friendly competition in your family to see who can save the most. This approach encourages teens to analyse their spending patterns, set realistic goals, and become more aware of their financial decisions.

Real-World Impact

When teens can see how much they’re spending on things like snacks, coffee, or streaming subscriptions, they begin to make smarter financial choices. Mint’s budget breakdowns help teens understand where their money is going, providing them with tangible insights that will stick with them long-term.

.

Visualize Spending and Set Financial Goals with Mint

2. Stash: Simplifying Investing for Beginners

Overview

What It Does: Stash is an investing app that allows users to buy fractional shares, making it easier for teens to get started in the world of investing without needing large sums of money. It’s a perfect introduction to the stock market and investing concepts, offering a hands-on approach to learning how to grow wealth over time.

Why Teens Love It: Stash takes the intimidating world of investing and makes it accessible for beginners. The app uses straightforward language to teach teens about investment basics, risk assessment, and portfolio diversification.

Family Activity with Stash

Engage your teen with a family investment challenge. Each family member can choose a few stocks or ETFs to follow and monitor their performance over time. This hands-on activity provides teens with firsthand experience in managing risk, tracking investments, and learning about market fluctuations.

Expert Insight: Finance educator Sarah Kim explains, “Stash is an excellent app for beginners. It demystifies the investing process and gives teens a practical, hands-on way to learn how to build wealth over time.”

Build Financial Knowledge and Confidence with Stash

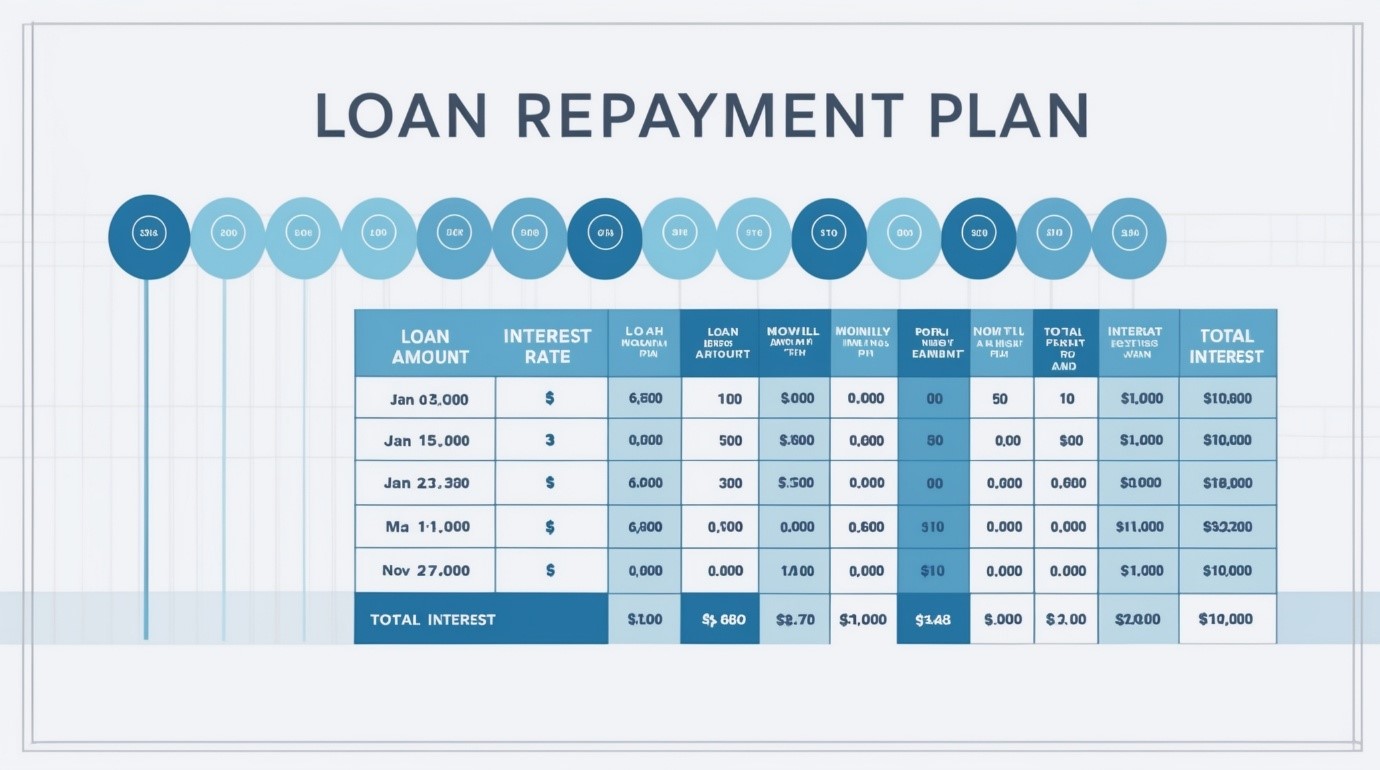

3. Debt Payoff Planner: Understanding the Realities of Borrowing and Debt

Overview

What It Does: Debt Payoff Planner is a powerful app that shows users how different repayment methods impact the overall cost of loans. It helps teens understand the realities of borrowing and the importance of managing debt responsibly.

Why Teens Love It: Debt Payoff Planner makes the concept of loan interest clear by showing how debt accumulates over time. It’s a great way for teens to visualize the real costs of credit cards, car loans, and student debt.

How to Use Debt Payoff Planner with Teens

Set up a hypothetical loan in the app (such as a student loan or credit card debt) and work with your teen to explore various repayment schedules. This activity helps teens understand the importance of paying off debt on time, avoiding high-interest loans, and planning for future financial obligations.

Practical Insight

By seeing a real-world example of debt repayment and the impact of interest rates, teens gain valuable insight into how borrowing works. This exercise encourages them to appreciate the value of saving and managing money to avoid the pitfalls of excessive borrowing.

Visualize Debt Impact with Real-Life Simulations.

4. BusyKid: Turning Chores into Financial Lessons

Overview

What It Does: BusyKid is an app that allows parents to assign chores to their teens, linking them to allowances and providing a simple way to manage earnings, savings, and donations. It’s a great tool for teaching teens the value of hard work and earning money.

Why Teens Love It: With BusyKid, teens get the opportunity to manage their own money by earning, saving, spending, and donating through a secure account. This sense of financial independence fosters responsibility and accountability.

Real-Life Application with BusyKid

Set up a small “economy” at home by assigning dollar values to different chores. Teens can use BusyKid to manage their earnings, decide how much to save, spend, or donate, and track their progress. This activity provides a hands-on way for teens to learn financial management, budgeting, and how to make informed financial decisions.

Expert Insight: Child psychologist Dr. Alex Rodriguez says, “BusyKid teaches not only financial management but also reinforces a strong work ethic and personal responsibility. It’s a fantastic tool for helping teens understand the link between effort and financial reward.”

Link Chores to Allowances and Build Financial Responsibility

Want to know about setting screen limits? Check: How to Set Up Screen Time Limits on Android Devices

5. Credit Karma: Demystifying the Mysteries of Credit

Overview

What It Does: Credit Karma helps teens understand the importance of credit scores and how their financial actions can impact their creditworthiness. The app offers simulated credit journeys, showing how different choices affect credit scores.

Why Teens Love It: Credit Karma takes the often-confusing world of credit and makes it accessible. Teens can simulate their own credit journey, seeing how factors like payment history, credit utilization, and loan balances influence their scores.

Practical Activity with Credit Karma

Use the Best Financial Literacy Apps for Teens, like Credit Karma’s credit score simulation feature, to demonstrate how different actions (such as paying bills on time or maxing out a credit card) affect credit scores. Teens can experiment with different scenarios to see how their credit score would change based on their financial decisions.

Family Challenge: Create a game where teens earn “credit points” for completing financial tasks (like paying bills on time or staying within budget). This gamified approach teaches teens the value of maintaining good credit without the real-world risks.

Building Credit Awareness in a Safe, Simulated Environment

Advanced Financial Education Activities for Parents and Teens

While financial literacy apps are an excellent tool for introducing teens to money management, there are also more in-depth activities you can do together to deepen their understanding:

1. The Role Reversal Game: Let Teens Become the Family’s Financial Advisor

Challenge your teen to create a family budget for the month. They will quickly learn about household expenses, savings goals, and the trade-offs involved in managing money.

2. The Million Dollar Question: Hypothetical Investing

Give your teen a virtual million dollars in an investing app and let them decide how to allocate it across different stocks or portfolios. Revisit the portfolio in a few weeks to discuss the results, analyzing both gains and losses.

3. The Hidden Fee Detective: Real-World Expense Audit

Ask your teen to audit the family’s monthly subscriptions and services for hidden fees. For each fee they identify and cut, let them decide where the savings will go—whether to an emergency fund, savings, or a family treat.

Related Guides to Expand Financial and Digital Literacy

To support your teen’s journey toward financial literacy, here are some additional guides to explore:

From game night to money management—family fun meets financial smarts with digital tools for everyone!

Conclusion: Empowering Teens to Be Financially Savvy

In conclusion, financial literacy apps offer an engaging, interactive, and accessible way for teens to learn essential money management skills. From budgeting and saving to investing and credit management, these apps empower teens to take control of their finances in a digital world. By using these tools and engaging in family activities, parents can guide their teens toward becoming financially responsible adults, preparing them for a future of financial independence and success.

Ready to turn financial learning into family fun? Explore these apps with your teen, create challenges, and watch them develop money-smart habits that will last a lifetime.

Learn how to balance your financial goals with the demands of parenting in our guide: Parenting and Financial Improvement: How to Manage Your Finances While Raising Kids.

While you’re working on improving your family’s financial future, don’t forget to take care of your mental well-being. Discover effective strategies for managing stress as a parent in our article: Parenting and Stress: How to Manage Your Mental Health While Raising Kids.